Description

Hello millennial learners! Congratulations, you made it to the next level of financial literacy.

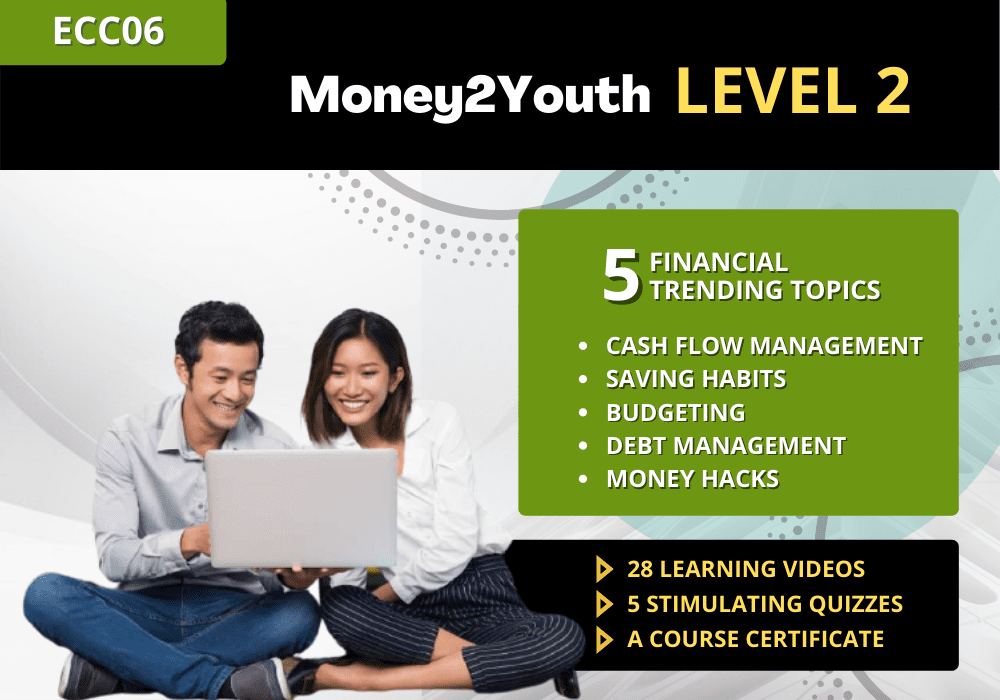

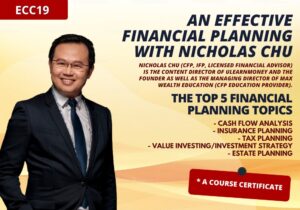

- This Financial Literacy Level 2 Course comprises of 5 financial trending topics, with a total of 28 learning videos and 5 quizzes.

- Learners are advised to spend at least one week to complete this course.

- You will receive a digital certificate upon completion of this Financial Literacy Level 2 course.

This course will assist you to grasp effectively on these topics mainly on saving habits, budgeting, debt management and life hacks for savings and financial management.

Topic 7 CASH FLOW MANAGEMENT

- In this topic, we will learn the most basic skills of financial planning: managing your cash. Recording your expenses and setting a budget may be basic, but it is the easiest and biggest step you can take to achieving financial freedom. Know what your budget priorities are, and grow your money if possible to enjoy a positive cash flow.

Topic 8 SAVING HABIT

- Developing a saving habit is fundamental to achieving financial freedom. Why is that so? The reason is twofold. Firstly, through the power of compound interest, your money will grow to an unbelievable size if you start saving early. Secondly, saving for an emergency fund will give you financial peace of mind should the worst happen. Here, we will demonstrate how to saving money, even as a student, will pay dividends later in life.

Topic 9 LEARN BUDGETING

- This topic in the series will cover the basics of budgeting. Budgeting may seem difficult, but by sticking to several basic rules, we can make drawing up a budget for yourself much easier. Furthermore, having the focus and discipline to stick to a budget can be difficult. Here, we will also show you how to achieve that budgeting discipline and be one step closer to financial freedom.

Topic 10 LOANS & DEBTS/PTPTN

- Debt is a scary phrase to many people, but it is an essential part of money management. Not all debt is bad. If you take on debt to help increase your net worth, e.g. to buy a house, it is ‘good’ debt. Here, we will also explain the role that PTPTN plays in managing your debt, as well as the tips and tricks to minimize your monthly PTPTN payments once you graduate.

Topic 11 LIFE HACKS ON SAVING

- In this topic, we will show you various money saving tips that you can apply throughout your daily life. From your groceries, to online shopping and saving petrol, we will show you how you can save your money without sacrificing on comfort. Use these tips to also look rich while saving money!

The average time to complete and learn this course: 1.5 to 2.5 hours

This course was curated by: Mr Nicholas Chu & Mr Brandon Ng

Name of presenters: Juztyn, Farah & Heidy

#Let’s elevate our financial literacy together! Happy learning! =)

aisyahrose –

What a great course to learn and enhance our money skills on saving habits, budgeting, debt management and life hacks for savings and financial management!! Enrolling in this Financial Literacy Level 2 Course is a must as I had completing learning the Level 1 Course of Money2Youth. So, don’t forget to get this course for yourself and your family members as well everyone!!!