7 Easy Ways to Create and Maintain A Budget

Creating a budget is the first crucial step in managing our finances. Suffice to say, it can be said that budgeting is the basic foundation of every financial plan. Some people said that budgeting is a dreary task. In fact, most of the times we often give excuses for doing budgeting and in the end, we hardly stick to it according to plan. Hmmm…let’s change our mindset about budgeting everyone.

Actually, learning how to budget is not a tough issue. It is all about time and effort, whether we can truly commit to keeping track and sticking to it. Once we create a budget, we will know how much money that we have and where it goes so that we are able to strategically plan how to allocate those earnings or funds best. Here are the easy ways to assist us create and maintain a budget effectively.

1. Figure out your financial stand

If we don’t know where to start or which path to take, we first need to identify and figure out our current financial state and goals. For example, perhaps we know that we’re in debt and therefore, we need to find ways or a system to help us learn how to balance our expenses, spending and savings. Once we are able to understand and know where we stand and what financial goals to accomplish, definitely we can execute an action or pick an option that leads us to set up our budget properly.

2. Identify and record your earnings

The second step towards creating a budget is that we need to record how much money is coming in monthly. If we have time to spare to do this task, we can record or track our earnings weekly, especially if we are among those who have multiple jobs or are doing side hustles. The easiest way is by listing out of all money coming in and of course this includes the amount and how often do we receive each earning. Nevertheless, if we don’t have a regular amount of income, we can simply work out an average amount to have a clear overview of our earning, and in this way, we are then be able to see where and how our money comes in. This money could be from our income, government payment or benefit, retirement pension, investments, and others.

3. Always record and keep track your spending

It is vital to always record and keep track our spending. Although most of us are aware and clear about where our money comes from, but surely we tend to neglect and not as certain about where it goes. Spending comprises everything that we spend our money on. Perhaps, we may need to gather our spending information from bank account or credit card statements, receipts and bills. By tracking our monthly expenses at least can help us to get an accurate picture of where our money is going and sort our finances as well as getting ahead efficiently.

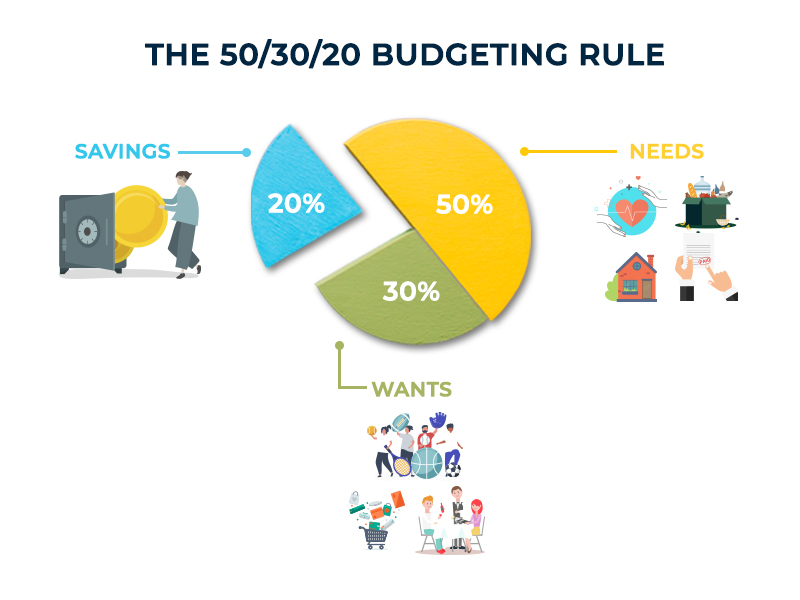

4. Get started with the 50/30/20 budget

What’s pleasing about this strategy is that it gives us space to cover present costs, pay off debts and a room to save for future expenses. In order to do this, we need to split our earnings across these three major categories: 50% goes to our necessities or needs, 30% goes to our wants and 20% goes toward our financial future and savings. Once our true and exact necessities such as groceries, transportation, utility bills, etc are taken care of, then only we can fill in the rest of the categories in our budget.

5. Make use of free budgeting apps

We should be thankful that nowadays, there are plenty and myriads of budgeting apps. Many of them are available free of charge and easy for us to download and install in our gadgets, including laptops, tablets and phones. This will make managing our money a breeze, save our time, hassle and will make life a whole lot easier rather than using the traditional pen and paper. It’s cool, isn’t it? With this budgeting tool, we can definitely focus more on planning a budget and keep track our spending from the comfort of our gadget!

6. Adjust your budget each month

Who says we cannot adjust our budget? Every month is different and it all depends on the variables of a situation that we may need to face in our daily lives. Some months, we will need to budget for things like car or housing maintenance, back-to-school supplies for our kids and other purposes. Meanwhile, other months, we may need to save money for things like preparation for festive seasons, birthdays and holidays. In other words, we can adjust our budget each month as things do change. This strategy can assist us to have a better plan, without being stressed about how to prepare for those monthly expenses in the budget. Thus, don’t be afraid to adjust your budget. Do evaluate your budget often and remain realistic.

7. Create and manage a budget plan together

![]()

For those who are married, you can have a family budgeting day once a month to keep track of family spending and expenses. Don’t make it too formal or a serious activity. You can put on a good playlist or even grab some snacks to help you and your life partner focus. Just sit down, discuss together and focus on what’s at hand. The key is to ensure that both you and your spouse are on the same page with money and financial management. Hence, do set financial goals together such as savings, vacation, child education and other important goals. Nevertheless, if you’re single, you can ask your close friend or sibling to act as your accountability partner to remind and help you stick to your financial goals. Most importantly, do prioritize and turn your budget into financial goals that work for you and your lifestyle.

All in all, creating and maintaining a budget can give us a sense of control over our money despite of our different economic standing and which generation we fall into. Creating a budget doesn’t mean that there will be no more shopping, eating out with friends and families, and doing fun activities.

Budgeting actually allows us to create a spending plan, and make sure that we will have sufficient money for the things that we need and the things that are important to us. Let’s start creating a simple budget now. By all means, we need to budget our finances in working toward a more financially sound future for ourselves and our family.