Description

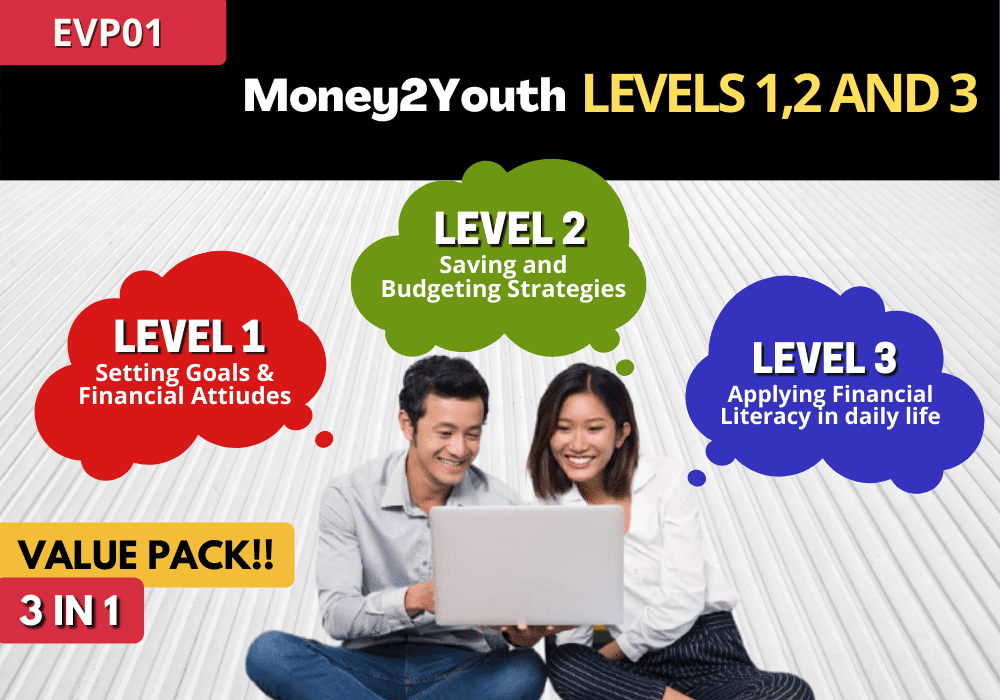

Hurry, get your uLearnMONEY Money2Youth today! Enroll in all the Three Levels of Financial Literacy Courses. You will ENJOY more benefits with this awesome Value Pack!

For a limited time, you’re now getting more than RM600 worth of value by just enrolling to uLearnMONEY Money2Youth today for ONLY RM147!!

But THAT’S NOT ALL!!!

You’ll also get:

1. Exclusive invitations to various future financial seminars and conferences by industrial experts, worth at least RM100 each

2. Free access to regular live webinars, worth at least RM50 per session

3. Personal financial online mentoring with certified financial planners, worth at least RM250 per hour

4. FREE Student Membership worth RM100 per year for the Malaysia Literacy in Financial Education Association (MyLIFE), an association with a mission to provide financial literacy for all Malaysians. *Terms & Conditions Apply

Money2Youth Level 1:

This course will assist you to comprehend effectively on these topics mainly on setting goals, financial planning, money attitudes and habits.

Topic 1: SCENARIO & INTRODUCTION

- Did you know that only 1 out of 3 Malaysian adults are financially literate? Let’s fix that now! In this first topic, we will highlight the common money dreams and concerns that most people wish to attain, while covering common financial pitfalls that we may encounter later in life. We will also introduce uLearnMONEY to you and how it can help you to achieve your financial freedom.

Topic 2: MY DREAM & MY GOAL

- When it comes to financial planning, organisation and focus should be our main priorities. This second topic will illustrate why being organised and staying focused are so important in managing our money. It will also show that organisation and focus isn’t as difficult as it sounds. Small steps in organizing our finances and focusing on a goal will help us to achieve our financial freedom immensely.

Topic 3: SETTING GOAL

- We have many ambitions in life. Becoming a great employer/employee, owning a house, or even just staying healthy and happy are just some of our goals in life. The third topic in this series will explain how prioritizing our goals will help in sorting out our life. Setting our priorities will help us to focus on what we want, which in this case, is financial freedom.

Topic 4: FINANCIAL FREEDOM AS YOUR GOAL IN LIFE

- To achieve your goal of financial freedom, you need to have the right mindset. In this lesson, we will learn the first step towards acquiring the knowledge and how to manage our money wisely. But first, we need to get ourselves into the right mindset before you take the plunge. When you do this, the rest of your journey towards financial freedom will be easy as 1-2-3.

Topic 5: FINANCIAL PLANNING

- This topic will cover what you need to know about the value of our Ringgit. Price does not necessarily equal value, but we need to know how to get the most value out of our Ringgit. Furthermore, the value of our currency will always decrease over time, thanks to the phenomenon of inflation. A million Ringgit in 1989 is only worth around RM400,000 now. That’s over half its value gone in only 30 years. Therefore, we need to know how to manage our money to maximize its value for us.

Topic 6: MONEY ATTITUDE & HABIT

- Our money habits will determine how we spend or save. If we constantly spend on luxuries and/or unnecessary items, we will never reach financial freedom. Even if we try and save, our social circle may also pressure us into spending more than we intended. In this topic, we will learn how to manage our attitude towards money, and master it to achieve our financial goals.

The average time to complete and learn this course: 1.5 to 2 hours

This course was curated by: Mr Nicholas Chu & Mr Brandon Ng

Name of presenters: Juztyn, Farah & Heidy

Money2Youth Level 2:

This course will assist you to grasp effectively on these topics mainly on saving habits, budgeting, debt management and life hacks for savings and financial management.

Topic 7 CASH FLOW MANAGEMENT

- In this topic, we will learn the most basic skills of financial planning: managing your cash. Recording your expenses and setting a budget may be basic, but it is the easiest and biggest step you can take to achieving financial freedom. Know what your budget priorities are, and grow your money if possible to enjoy a positive cash flow.

Topic 8 SAVING HABIT

- Developing a saving habit is fundamental to achieving financial freedom. Why is that so? The reason is twofold. Firstly, through the power of compound interest, your money will grow to an unbelievable size if you start saving early. Secondly, saving for an emergency fund will give you financial peace of mind should the worst happen. Here, we will demonstrate how to saving money, even as a student, will pay dividends later in life.

Topic 9 LEARN BUDGETING

- This topic in the series will cover the basics of budgeting. Budgeting may seem difficult, but by sticking to several basic rules, we can make drawing up a budget for yourself much easier. Furthermore, having the focus and discipline to stick to a budget can be difficult. Here, we will also show you how to achieve that budgeting discipline and be one step closer to financial freedom.

Topic 10 LOANS & DEBTS/PTPTN

- Debt is a scary phrase to many people, but it is an essential part of money management. Not all debt is bad. If you take on debt to help increase your net worth, e.g. to buy a house, it is ‘good’ debt. Here, we will also explain the role that PTPTN plays in managing your debt, as well as the tips and tricks to minimize your monthly PTPTN payments once you graduate.

Topic 11 LIFE HACKS ON SAVING

- In this topic, we will show you various money saving tips that you can apply throughout your daily life. From your groceries, to online shopping and saving petrol, we will show you how you can save your money without sacrificing on comfort. Use these tips to also look rich while saving money!

The average time to complete and learn this course: 1.5 to 2.5 hours

This course was curated by: Mr Nicholas Chu & Mr Brandon Ng

Name of presenters: Juztyn, Farah & Heidy

Money2Youth Level 3:

This course will guide you to apply financial tips effectively on these topics mainly on healthy money mindsets, awareness on scams and money games, startup, entrepreneurship, income creation, buying a house & a car, credit card and Fintech.

Topic 12 MINDSET CHANGES

- Just thinking about financial freedom is not enough. We have to motivate yourself to do it. In this topic, we will explore the mindset of an independent, financially secure person. Although we have already covered some of this is Topic 4, Topic 12 is a more in-depth look into how you can motivate yourself into developing the required mindset for financial freedom.

Topic 13 SCAM & MONEY GAMES

- If it sounds too good to be true, it probably is. That’s the age-old saying to warn you away from financial scams. Here, we will show you how money scams operate, and how you can avoid falling prey to one. There’s a reason why money is not easy to earn, so always do your research and be wary if the returns are too good to be true.

Topic 14 STARTUP AND ENTREPRENEURSHIP

- Starting your own business can be an appealing concept for some, and terrifying for others. If you want to strike out on your own, especially after graduating, you have to weigh many considerations. Are you a multitasker? Do you favour stability? Can your passion be turned into a business? And most importantly, are you willing to risk it all? This topic will introduce you to the concept of entrepreneurship and whether it is right for you.

Topic 15 INCOME CREATION

- Earning money is not easy. However, you can make it (slightly) easier by leveraging on your resources. Leveraging simply means to multiply one’s efforts, like how a lever is used to move much heavier objects. By using your time, connections, and knowledge, you can leverage and multiply your income in an easier fashion. This topic will show you how.

Topic 16 BUYING HOUSE & CAR

- Buying a house is definitely number one on many people’s list of financial goals. Here, we will discuss why and how you should buy a house within five years of starting your career. We will also explore how to look for properties that are suitable for your first house.

Topic 17 INSURANCE

- In case of emergency, insurance is your shield against financial ruin. Though we covered emergency funds in Topic 8, here we will discuss how insurance can help you should the worst happen. While you may think insurance is unsuitable for a student on a limited budget, paying into a medical plan will pay off in the long run.

Topic 18 CREDIT CARD

- Credit cards can be most useful money management tool in your arsenal; or it can be the most ruinous. Depending on how you use it, credit cards offer many advantages in managing your money. However, if you overspend on your credit card, it can quickly drain your bank account. Here, we will discuss the topic of credit cards for students, including tips on using your credit card, as well as how to protect yourself from credit card fraud.

Topic 19 FINTECH

- This topic will assist you to understand about the usage of Fintech in our daily lives. Fintech refers to the financial technology that is used to support and enable banking and financial services. Hence, this topic will introduce you with regard to E-wallet, blockchain and cryptocurrency.

The average time to complete and learn this course: 1.5 to 2 hours

This course was curated by: Mr Nicholas Chu & Mr Brandon Ng

Name of presenters: Juztyn, Farah, Heidy & Jsen

Reviews

There are no reviews yet.