Description

Hi millennial learners!

Congratulations to you that you have completed the two fundamental levels of financial literacy. We believe you had learned a fair bit of financial literacy and therefore, keep learning!

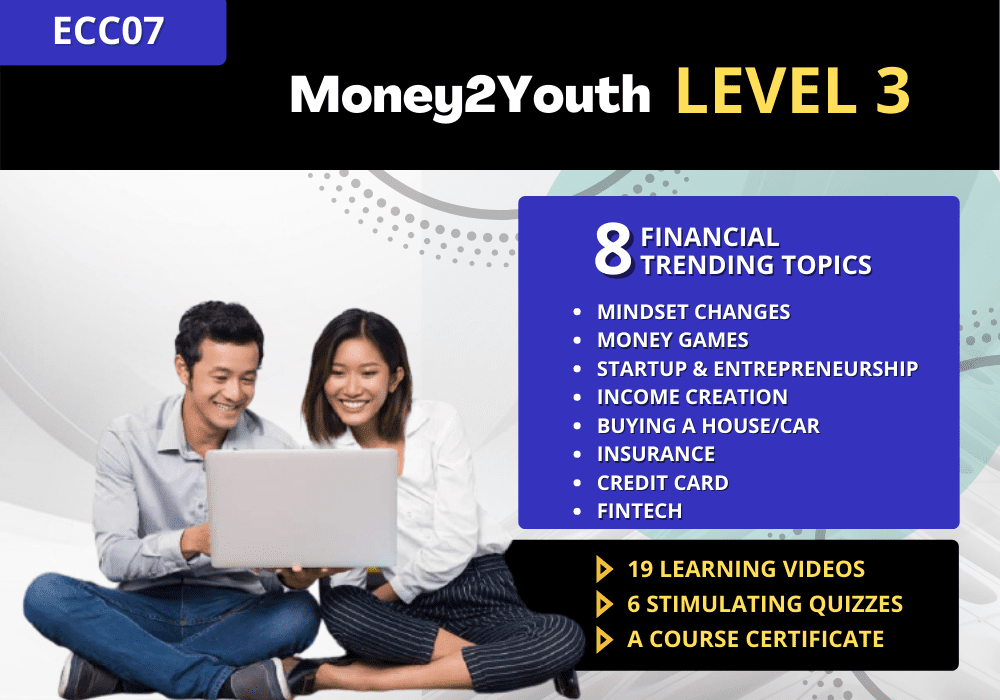

- Moving on, this Financial Literacy Level 3 Course consists of 8 financial trending topics, with a total of 19 learning videos and 6 quizzes.

- Learners are advised to spend at least one week in order to complete this course.

- You will receive a digital certificate upon completion of this Financial Literacy Level 3 course.

This course will guide you to apply financial tips effectively on these topics mainly on healthy money mindsets, awareness on scams and money games, startup, entrepreneurship, income creation, buying a house & a car, credit card and Fintech.

Topic 12 MINDSET CHANGES

- Just thinking about financial freedom is not enough. We have to motivate yourself to do it. In this topic, we will explore the mindset of an independent, financially secure person. Although we have already covered some of this is Topic 4, Topic 12 is a more in-depth look into how you can motivate yourself into developing the required mindset for financial freedom.

Topic 13 SCAM & MONEY GAMES

- If it sounds too good to be true, it probably is. That’s the age-old saying to warn you away from financial scams. Here, we will show you how money scams operate, and how you can avoid falling prey to one. There’s a reason why money is not easy to earn, so always do your research and be wary if the returns are too good to be true.

Topic 14 STARTUP AND ENTREPRENEURSHIP

- Starting your own business can be an appealing concept for some, and terrifying for others. If you want to strike out on your own, especially after graduating, you have to weigh many considerations. Are you a multitasker? Do you favour stability? Can your passion be turned into a business? And most importantly, are you willing to risk it all? This topic will introduce you to the concept of entrepreneurship and whether it is right for you.

Topic 15 INCOME CREATION

- Earning money is not easy. However, you can make it (slightly) easier by leveraging on your resources. Leveraging simply means to multiply one’s efforts, like how a lever is used to move much heavier objects. By using your time, connections, and knowledge, you can leverage and multiply your income in an easier fashion. This topic will show you how.

Topic 16 BUYING HOUSE & CAR

- Buying a house is definitely number one on many people’s list of financial goals. Here, we will discuss why and how you should buy a house within five years of starting your career. We will also explore how to look for properties that are suitable for your first house.

Topic 17 INSURANCE

- In case of emergency, insurance is your shield against financial ruin. Though we covered emergency funds in Topic 8, here we will discuss how insurance can help you should the worst happen. While you may think insurance is unsuitable for a student on a limited budget, paying into a medical plan will pay off in the long run.

Topic 18 CREDIT CARD

- Credit cards can be most useful money management tool in your arsenal; or it can be the most ruinous. Depending on how you use it, credit cards offer many advantages in managing your money. However, if you overspend on your credit card, it can quickly drain your bank account. Here, we will discuss the topic of credit cards for students, including tips on using your credit card, as well as how to protect yourself from credit card fraud.

Topic 19 FINTECH

- This topic will assist you to understand about the usage of Fintech in our daily lives. Fintech refers to the financial technology that is used to support and enable banking and financial services. Hence, this topic will introduce you with regard to E-wallet, blockchain and cryptocurrency.

The average time to complete and learn this course: 1.5 to 2 hours

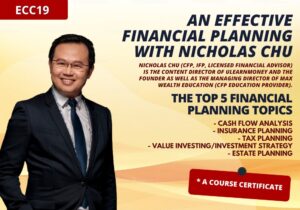

This course was curated by: Mr Nicholas Chu & Mr Brandon Ng

Name of presenters: Juztyn, Farah, Heidy & Jsen

#Let’s elevate our financial literacy together! Happy learning! =)

aisyahrose –

Getting this Financial Literacy Level 3 Course is truly a worthwhile after enrolling in the Financial Literacy Levels 1 and 2 Courses!! I gained meaningful tips and advice mainly on healthy money mindsets, awareness on scams and money games, startup, entrepreneurship, income creation, buying a house & a car, credit card and Fintech. What are you waiting for everyone?? Get yours now today too! Smart MONEY, Smart YOU!! (^-^)